Financial planning is the practice of putting together a plan for your future, specifically around how you will manage your finances and prepare for all of the potential costs and issues that may arise. It is more than budgeting, saving, or the perfect investment strategy. It sets you on a course toward achieving your life goals through the proper management of your financial affairs.

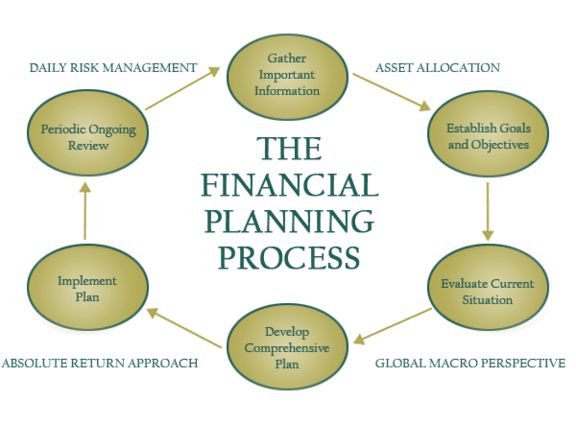

To get started with financial planning, you can follow these steps:

1. Set your financial goals: Identify your short-term and long-term financial goals. These could include saving for retirement, buying a house, or paying off debt.

2. Assess your current financial situation: Take stock of your income, expenses, assets, and liabilities. This will help you understand your current financial standing and identify areas for improvement.

3. Create a budget: Develop a budget that outlines your income and expenses. This will help you track your spending, identify areas where you can cut back, and ensure you’re saving enough to meet your goals.

4. Manage your debt: If you have any outstanding debt, create a plan to pay it off. Consider strategies such as the debt snowball or debt avalanche method to accelerate your progress.

5. Save and invest: Establish an emergency fund to cover unexpected expenses and start saving for your goals. Explore different investment options, such as stocks, bonds, or mutual funds, to grow your wealth over time.

6. Protect yourself and your loved ones: Review your insurance coverage, including life, health, and disability insurance. Ensure you have adequate coverage to protect against unforeseen events.

7. Monitor and adjust your plan: Regularly review your financial plan and make adjustments as needed. Life circumstances and goals may change, so it’s important to stay flexible and adapt your plan accordingly.

Remember, financial planning is a personalized process, and it’s always a good idea to consult with a financial advisor or planner who can provide tailored advice based on your specific needs and goals.

Let me know if you need further assistance or have any other questions! ??