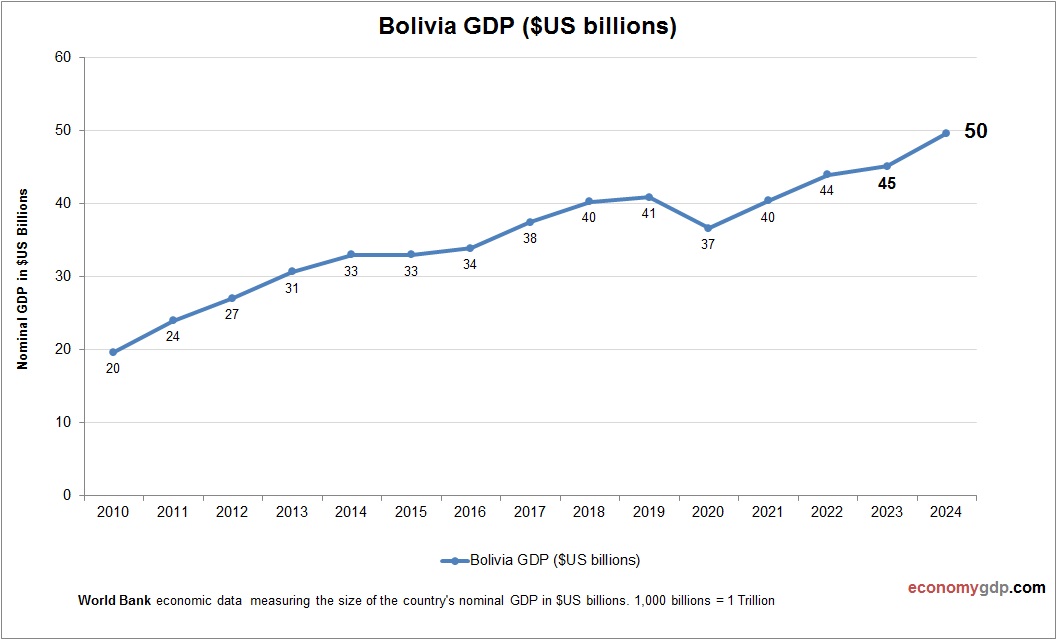

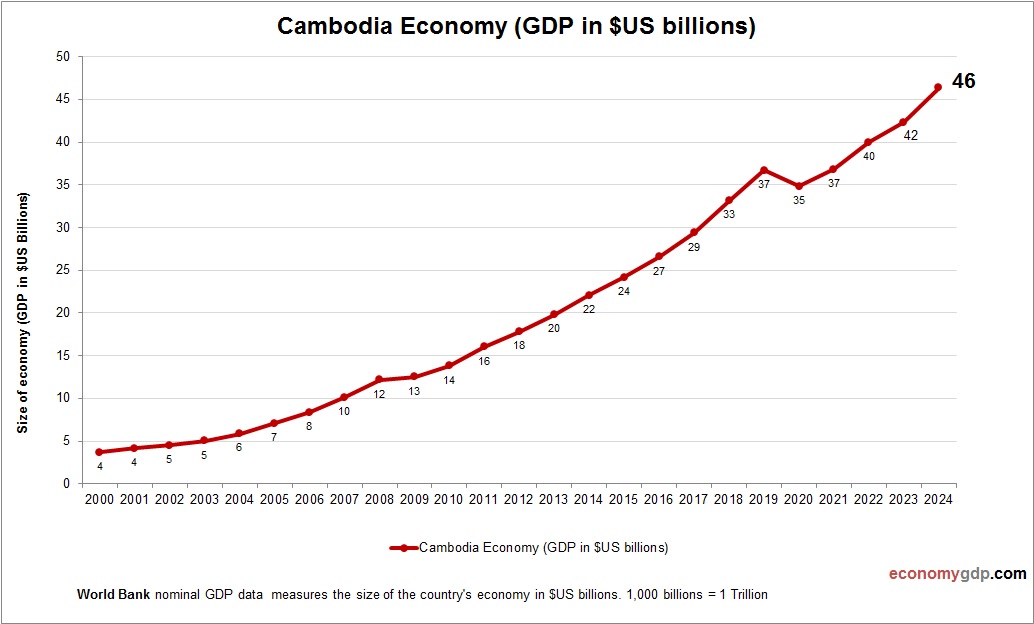

Cambodia Economy in Graphs

The Cambodia economy thrives on garment exports, tourism, and agriculture. Textiles dominate exports, while Angkor Wat drives tourism revenue. Rice and rubber are key agricultural outputs. Rapid urbanization and foreign investment, particularly from China, fuel growth, but poverty, weak infrastructure, View diagram Cambodia Economy in Graphs