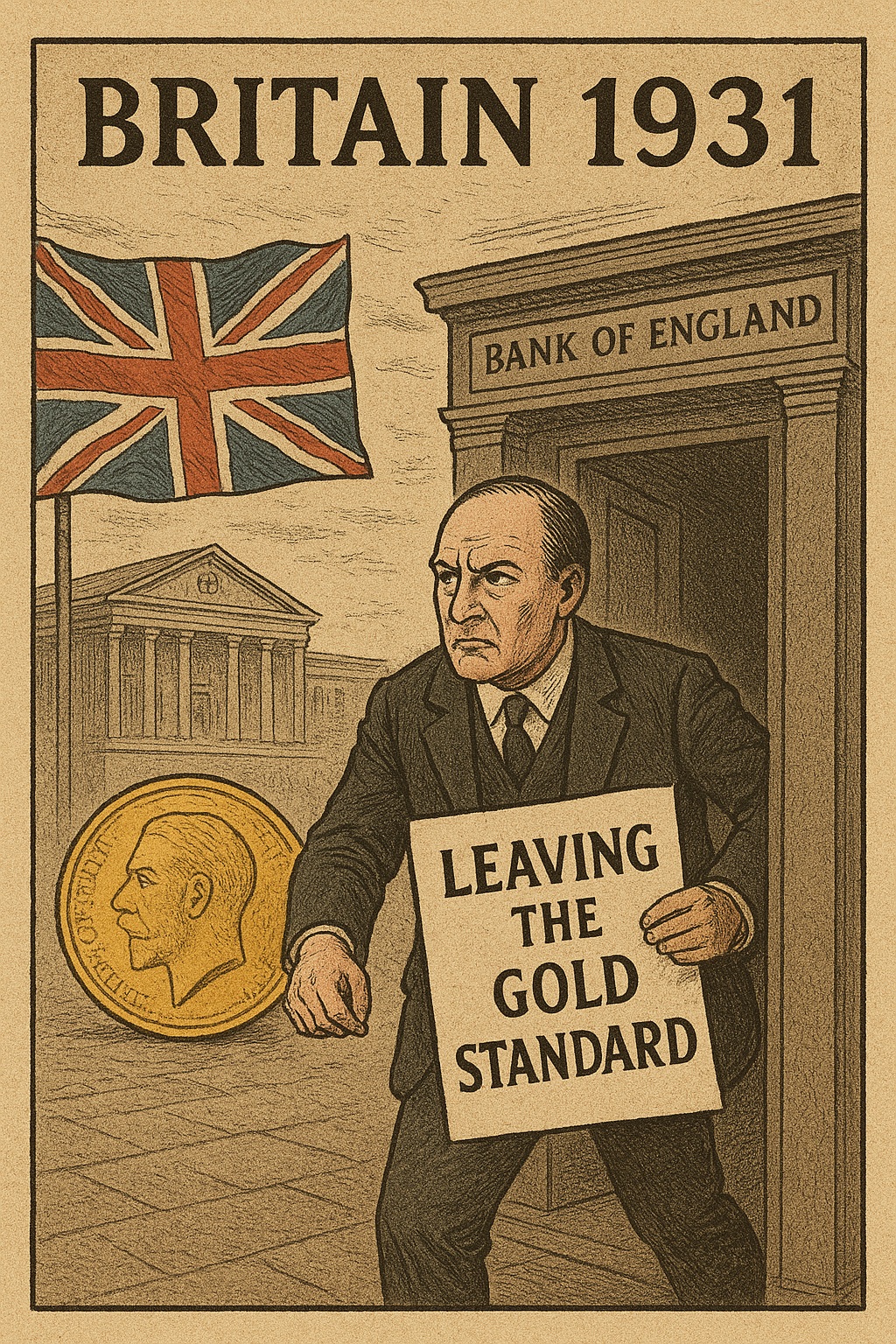

Britain left the gold standard in 1931, allowing monetary flexibility and influencing global financial policy shifts. In September 1931, Britain’s decision to abandon the gold standard marked one of the most dramatic turning points in modern economic history. For years, the gold standard had been seen as a symbol of financial credibility, binding the pound to a fixed amount of gold and limiting the government’s ability to expand the money supply. But the Great Depression had pushed this system to its breaking point. A shrinking global economy, declining exports, and severe pressure on Britain’s gold reserves created an unsustainable imbalance. Speculators, fearing devaluation, launched massive attacks on the pound, rapidly draining the Bank of England’s gold. Faced with the choice between defending the currency through deeply austere measures or allowing the pound to float, the National Government chose the latter—ending decades of monetary orthodoxy.