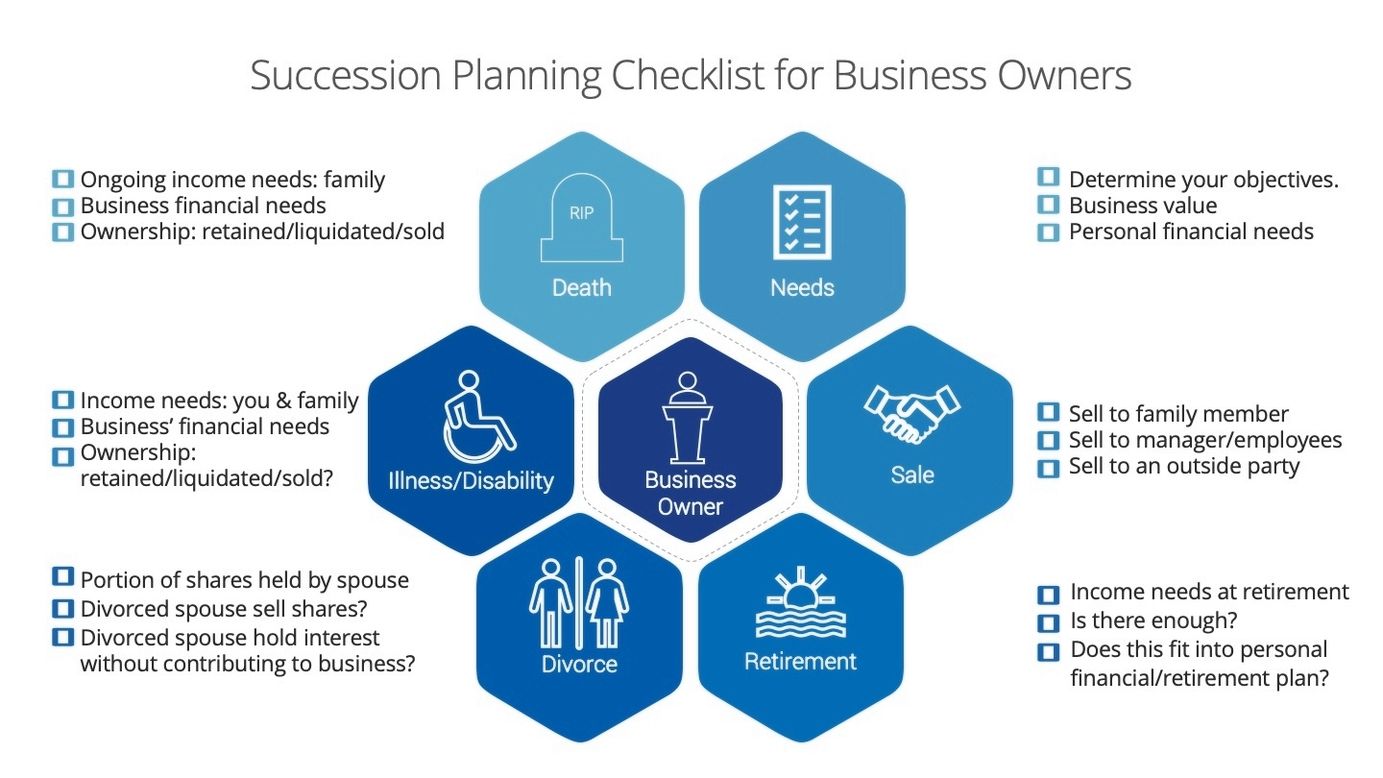

Succession planning is a process that helps companies prepare for the future by passing leadership roles or ownership to other employees or individuals. The process involves identifying and developing potential successors, creating a strategy and a document that covers all possible scenarios and contingencies, and communicating and implementing the plan. Business succession planning can provide benefits such as continuity, tax breaks, and more options for the business owners. Business succession planning can be started at any time, but it is advisable to begin early .

According to a survey conducted by the Canadian Federation of Independent Business (CFIB), less than 20% of small businesses have done any succession planning, and less than 10% have prepared a formal business succession plan .

A solid financial plan is the cornerstone of a successful succession process. If you intend to sell your business to someone outside the family, it’s important to clean up the balance sheet (called doing a corporate purification) and get a business valuation. When tax planning, its important to weigh the merits of an asset sale vs. a sale of shares ?.

A qualified advisor can help you better understand your succession planning options, especially given your own unique business and family situation. If youre considering selling to a family member or key employee, make sure to include them in your discussions ?.

The Business Development Bank of Canada (BDC) provides an extensive guide on how to plan your succession strategy effectively. It covers topics such as developing a long-term vision for the business, creating a timeline to help keep the succession plan on track, establishing retirement and post-ownership goals, setting milestones for achieving goals and objectives, and more .