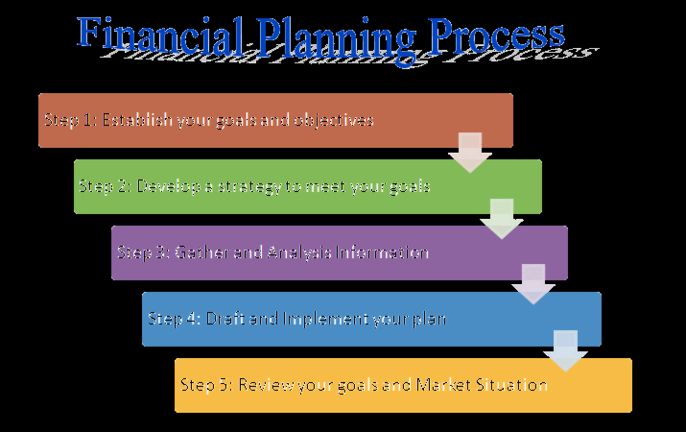

The financial planning process is a comprehensive and iterative process that helps individuals and businesses achieve their financial goals. The process typically consists of seven steps :

1. Understanding the client’s personal and financial circumstances: This step involves gathering information about the client’s current financial situation, including their income, expenses, assets, liabilities, and risk tolerance.

2. Identifying and selecting goals: In this step, the client’s financial goals are identified and prioritized based on their importance.

3. Analyzing the client’s current course of action and potential alternative course(s) of action: This step involves evaluating the client’s current financial plan and identifying potential alternative courses of action that could help them achieve their goals.

4. Developing the financial planning recommendation(s): Based on the information gathered in the previous steps, a comprehensive financial plan is developed that outlines specific recommendations to help the client achieve their goals.

5. Presenting the financial planning recommendation(s): The financial plan is presented to the client, along with an explanation of how it will help them achieve their goals.

6. Implementing the financial planning recommendation(s): Once the client has agreed to the recommendations outlined in the financial plan, they are implemented.

7. Monitoring progress and updating: The final step in the process involves monitoring progress towards achieving the client’s goals and updating the financial plan as necessary to ensure that it remains relevant and effective.