”

”

Country’s Nominal GDP is measured in US dollars unadjusted for relevant prices between countries, i.e. the dollar value of all goods and services produced. Purchasing Power Parity GDP (PPP GDP) tries to adjust for the differences in prices between countries, balancing things out and showing a more fair comparison between countries.

Here are a couple of easy examples to explain the difference. A same haircut in Indonesia will cost a fraction of a cost in US, e.g. $2 vs. $20. However, it may be exactly the same haircut and thus, people in Indonesia cannot be considered worse off, i.e. the relevant contribution to GDP should be judged similarly. Another example, is a price of McDonald’s Big Mac in various countries. It may cost $5 in US but only $1.50 in Eastern Europe. Again, it is more or less the same Big Mac, and its contribution should be the same across countries. In fact, there is a Big Mac index that estimates the fair exchange rate between currencies for different countries based on this discrepancy.

The differences are largely driven by services because they are dependent on human labor, with the main input being employee salary. This widely varies across the world causing such differences. On the other hand, commodities are traded on global exchanges and their price is very similar around the world, so it does not really explain the differences in price levels and GDPs between countries. Exceptions to the rule exist (e.g. price of gasoline) as some countries have abundance of a particular resource (e.g. oil) and/or government subsidies.

The difference between nominal and PPP GDPs are more pronounced in Emerging Markets (e.g. Indonesia, India, Russia) where salaries are relatively low. PPP GDP there can be significantly higher than Nominal GDP. The differences are less pronounced in developed markets. Some markets may appear rich in nominal terms but are lower in PPP terms (e.g. Norway) because things are generally more expensive there even though salaries are high.

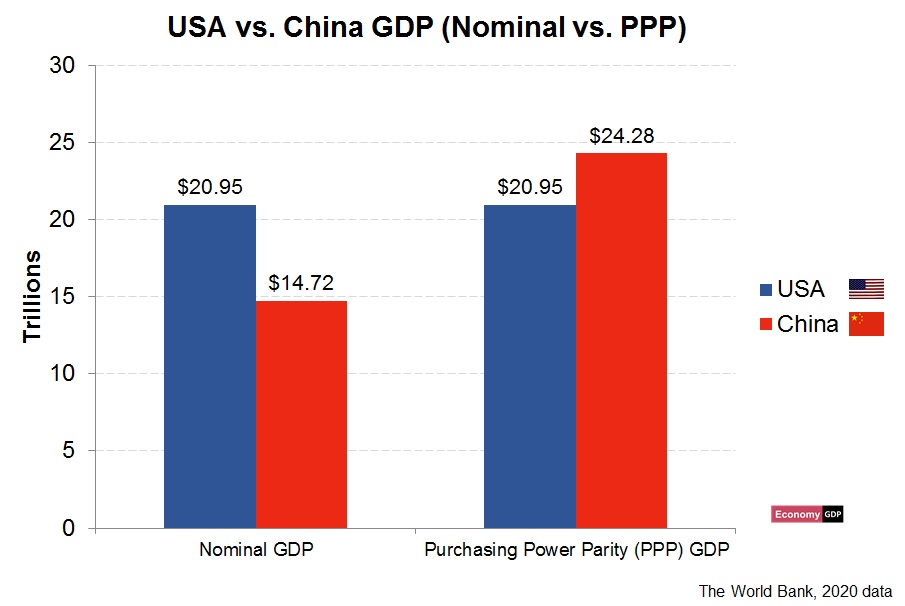

USA vs. China GDP (Nominal and PPP)

One interesting case of Nominal vs. Purchasing Power Parity GDP occurs between USA and China. Many scholars argue, which economy is bigger. That is dependent on whether you are considering nominal or PPP economy size. As of 2020 data (this article is published in May 2022), USA was much ahead in nominal terms but was significantly trailing in PPP terms. See the graph below explaining the difference. So which economy is bigger in your opinion? Also, note how both figures are the same for USA as PPP is measured in current US dollars.