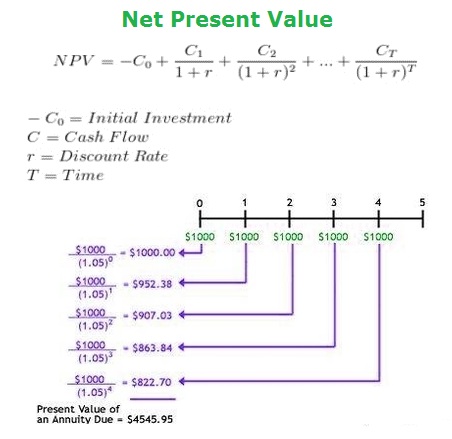

NPV – Net Present Value – How to calculate net present value (NPV)? Net present value is calculated as a sum of cash flow through project life cycle adjusted to the discount interest rate. NPV is calculated to estimate the net benefit of a project and other types of multiyear engagements. NPV Calculation Diagram – net present value calculation methodology.

NPV is a key finance tool. Usually, the initial cashflow is negative due to the investment required (e.g. purchase of new equipment). As time progresses, the company starts to generate positive cash flow. The further away is the cashflow, the more discounted it becomes (i.e. cash today is worth more than the same amount of cash in the future).