Israel’s economy is driven by technology, defense, and agriculture. Known as the Startup Nation, it leads in cybersecurity, AI, and software, with firms like Check Point. Defense exports, including drones, are significant, while high-tech agriculture thrives in arid conditions. Emerging industries include health tech, with medical devices and digital health, and renewable energy, particularly solar. Israel’s innovation ecosystem and skilled workforce fuel growth, though geopolitical risks persist. Investments in quantum computing and green tech enhance its global role. Israel’s focus on R&D and tech exports positions it as a leader in high-tech innovation.

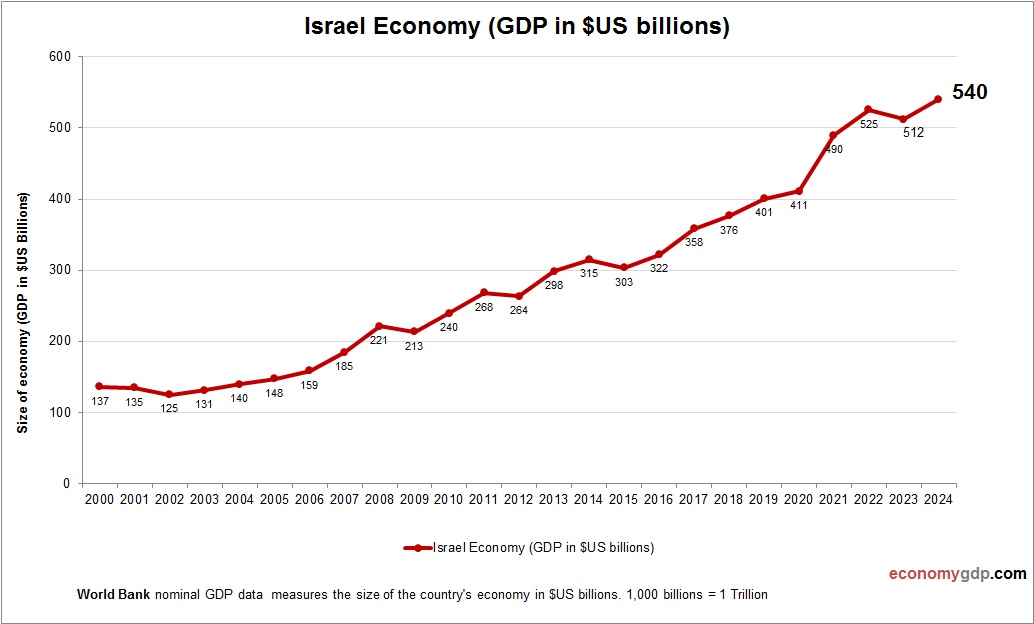

Israel Economy Size

Israel’s economy has a nominal GDP of around $400 billion. Technology, defense, and agriculture drive its size, with cybersecurity and AI leading globally. Its GDP reflects a highly innovative, startup-driven economy. Investments in health tech and renewable energy enhance growth, positioning Israel as a global tech hub despite its small size, with significant influence in high-tech and defense industries. See Israel GDP.

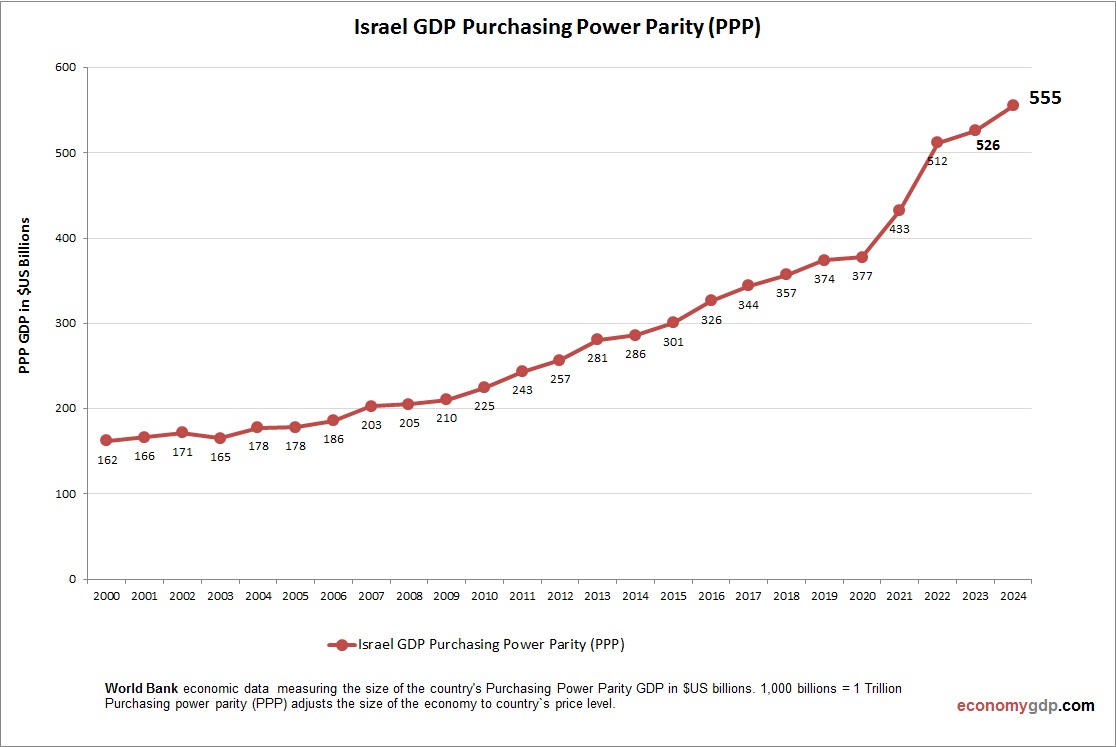

Israel Purchasing Power Parity (PPP)

Israel’s economy has a PPP GDP of about $550 billion. Technology, defense, and agriculture drive its size, with moderate costs boosting purchasing power. Its cybersecurity and AI leadership amplifies its PPP GDP, supporting strong innovation. Investments in health tech and renewable energy enhance its scale, positioning Israel as a global tech hub with significant influence despite its small geographic size.

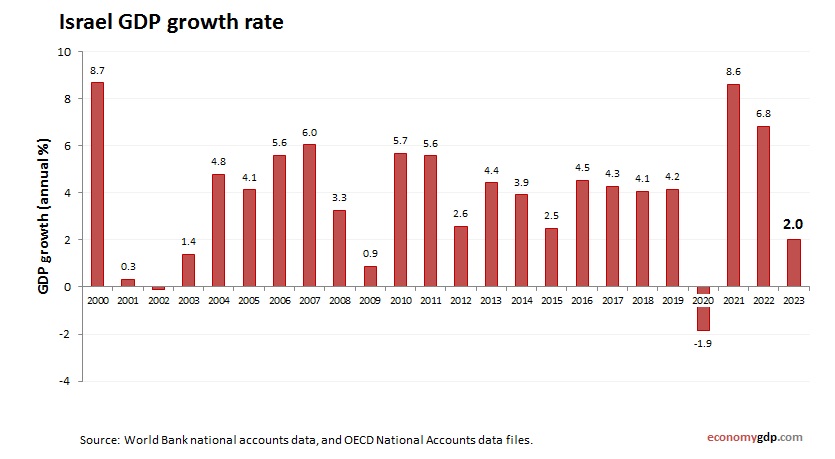

Israel Growth Rate

Israel’s economy is expected to grow at 2.4% in 2025. Technology, defense, and agriculture fuel expansion, with cybersecurity and AI leading globally. Investments in health tech and renewable energy support growth, though geopolitical tensions and regional conflicts pose risks. Israel’s innovation-driven economy and startup ecosystem ensure robust growth, positioning it as a global tech hub despite its small size and external challenges.

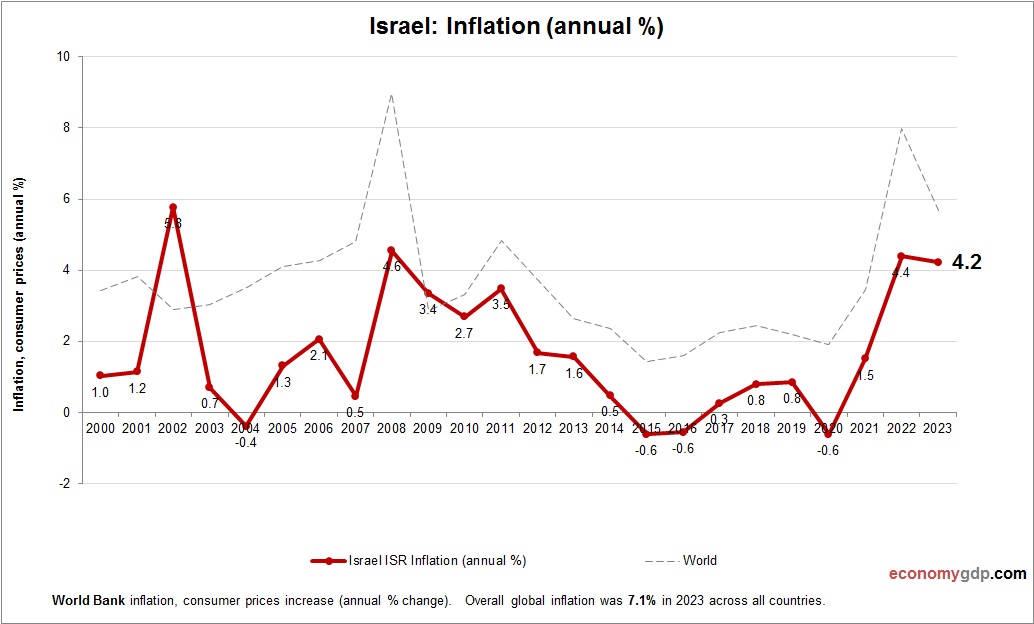

Israel Inflation

The Israel’s inflation is low at 2%, driven by stable import prices and tech export demand. Strong cybersecurity and AI sectors add minor pressure, but tight monetary policy and cautious spending curb inflation. Geopolitical tensions and energy costs contribute modestly, while investments in health tech ensure low inflation, supporting Israel’s innovation-driven economic stability.