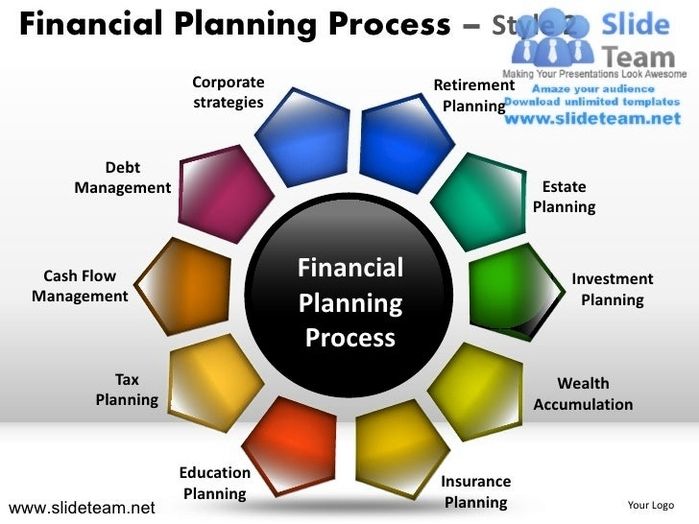

The financial planning process is a series of steps followed by financial planners to develop and implement strategies that help clients manage their financial affairs and meet their life goals. It typically includes the following key steps:

1. Understanding personal and financial circumstances: This involves gathering relevant financial information and understanding the client’s current financial situation.

2. Identifying goals and expectations: Financial planners work with clients to identify their short-term and long-term financial goals, as well as their expectations for the planning process.

3. Analyzing the financial situation: Financial planners analyze the client’s financial data, including income, expenses, assets, and liabilities, to gain a comprehensive understanding of their financial situation.

4. Developing a financial plan: Based on the analysis, financial planners develop a customized plan that outlines specific strategies and recommendations to help clients achieve their goals.

5. Reviewing the plan: The financial plan is reviewed with the client to ensure it aligns with their goals and expectations. Any necessary adjustments or refinements are made at this stage.

6. Implementing the plan: Once the client approves the financial plan, it is put into action. This may involve making investment decisions, setting up savings or retirement accounts, or taking other steps outlined in the plan.

7. Monitoring and adjusting: Financial planners regularly monitor the client’s progress towards their goals and make adjustments to the plan as needed. This ensures that the plan remains relevant and effective over time.

It’s important to note that each individual’s financial planning process may vary depending on their unique circumstances and goals. Professional financial planners follow ethical standards and competency requirements set by organizations like FP CanadaTM to ensure they provide high-quality services to their clients.