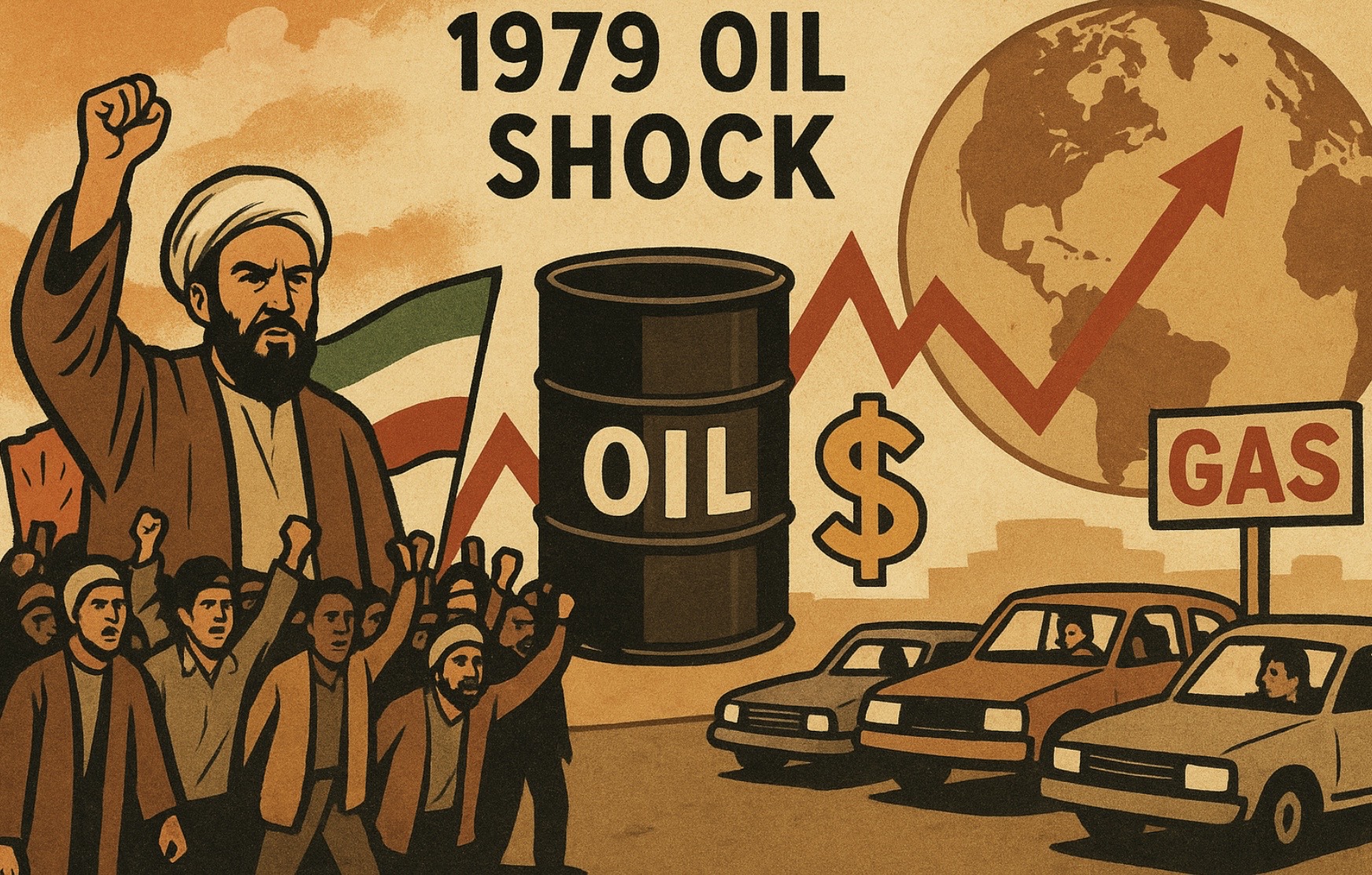

Following Iran’s 1979 revolution, oil prices surged, sparking recessions globally and illustrating how political upheaval can dramatically affect the world economy.

The Oil Shock, triggered by the Iranian Revolution, marked one of the most significant disruptions in modern energy and economic history. When mass protests and political upheaval in Iran culminated in the overthrow of the Shah, the country’s oil production plunged by roughly two-thirds almost overnight. As one of the world’s largest oil exporters at the time, Iran’s sudden withdrawal from global markets created fear and uncertainty across energy-dependent economies. Crude oil prices more than doubled within a year, rising from about $15 to over $39 per barrel, and nations heavily reliant on Middle Eastern oil scrambled to secure alternative supplies. This crisis exposed the fragility of global energy systems and underscored how quickly geopolitical turmoil could translate into economic shockwaves felt worldwide.

The impact extended far beyond fuel shortages and long lines at gas stations. The surge in oil prices contributed to soaring inflation, slowing industrial output, and a deepening sense of economic instability in many Western economies. In the United States and Europe, policymakers struggled to combat “stagflation”—a rare combination of high inflation, high unemployment, and slow growth. Developing nations, many already burdened by debt, faced even harsher consequences as the cost of imported energy soared. The 1979 shock also reshaped long-term energy policy: governments invested more heavily in strategic petroleum reserves, fuel efficiency standards tightened, and interest in alternative energy sources—nuclear, solar, and conservation measures—grew rapidly. Ultimately, the crisis demonstrated that global economic stability was tightly intertwined with political events in key oil-producing regions, a lesson that continues to influence energy policy and international relations today.